You already know the answer. In my experience, organisations already report the key metrics their business needs to know what a good customer experience (CX) looks like. However, data is often lost – buried deep within departmental KPI reports. While data silos lock information within one department, even though it could prove valuable to others.

We need to create visibility of the information we already have and encourage people to view the data through the right lens.

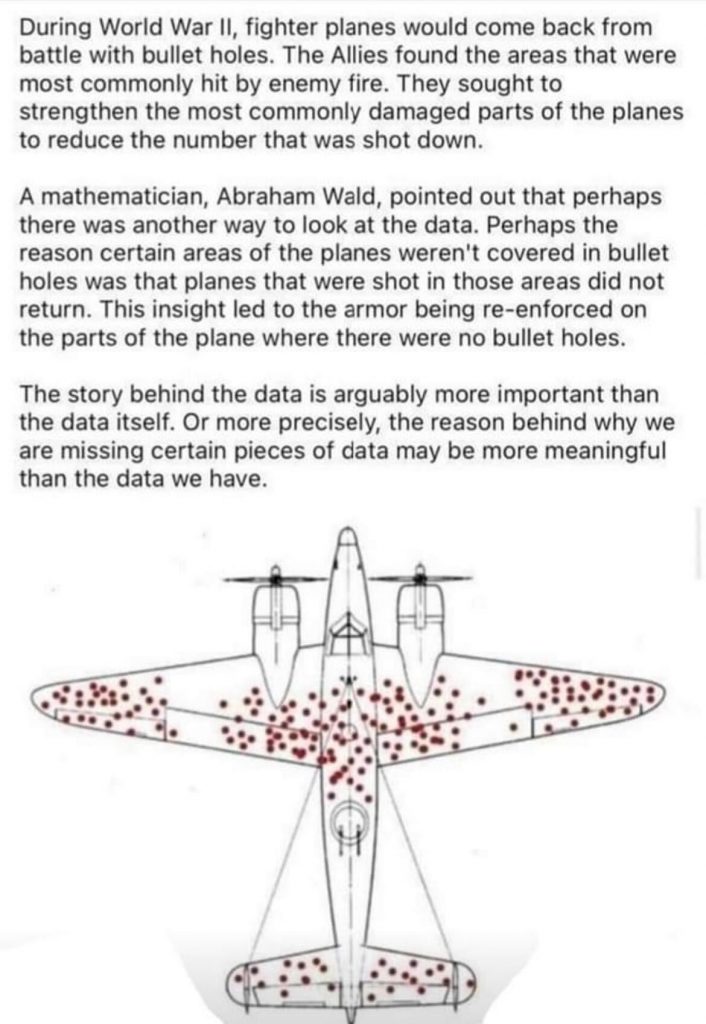

Take a look at this example:

If the data was taken at face value, yes, there would probably have been an improvement – we could expect to see a reduction in the number of bullet holes in the planes that came back. But it wouldn’t have addressed the real issue – the vulnerabilities in the plane that caused so many to be lost.

How we interpret data is crucial to the decisions we make. It’s why we need greater visibility of all data. To break down silos, focus on the important metrics and join the dots to unlock the valuable insights of how to continuously improve.

Your customers tell you everything you need to know

It costs 5x as much to attract a new customer compared to keeping an existing one. And yet less than a fifth of companies place their focus on customer retention.

Why?

If you can boost your customer retention rate by just 5%, it could increase your profit by 25%-95%. Not only does their lifetime value increase, the number of referrals and positive reviews you receive increases, which drive new sales.

It’s super powerful to bring to life trends around continuous improvement or detractors with actual sound bites of voice or video where possible. After all, what is more useful and easier to action:

“90% rates our customer service as good.”

Or…

“Really quick service. The box on the inside came ripped but I guess it was due to the trip.”

“Arrived earlier than expected. The presentation box is lovely, very nice heavy cardstock, however, mine came somewhat misshapen.”

“Beautiful item but the box was crushed. Spoke to Laura in customer service who arranged a replacement.”

Additionally, you can encourage retention by using your segmentation data to consider how targeting your customers in different ways could affect their spending and lifetime value. For example, it could be through different messaging, imagery, channels, times, products, offers…the possibilities are endless. When you wrap these insights into your five-year sales projection, not only does it give the Board greater confidence in how you will support the organisation’s growth plans, it also helps you gain buy-in for any help you may need to get there.

How to develop mechanisms to capture the right CX data

Capturing CX data is relatively simple:

- Unsolicited: for example, you could measure brand awareness, or interpret what your website analytics are telling you.

- Solicited: for example you could issue quarterly satisfaction surveys, or link a survey to every contact channel.

But the data itself isn’t enough – knowing you had 5 complaints last month doesn’t help inform what you need to do to improve. Therefore, make sure you capture the reason(s) behind the contact/complaint. For example, if all 5 complaints list ‘damaged’ as the return reason, you can investigate the packaging or delivery process. Also, ensure you have conducted a recent health check on the validity of the ‘reason’. Often these are not reviewed and become obsolete over time. Or a better descriptive reason is more meaningful.

Of course, the most powerful data you can collate is through face-to-face customer sessions. Leverage the right technology and ‘ethnography’ allows you to observe customers’ reactions and behaviours in the moment and in their own environment.

And here lies the problem.

Data is so accessible today that we collect everything we can get our hands on. Then the data that really matters gets lost in those KPI reports. Before you establish the mechanisms, it’s important to consider what problem you’re trying to address, as this will influence the type of data you need, and how you acquire it.

Start by thinking about how to link the CX strategy to the overall corporate strategy. It doesn’t matter what question you ask the business, it’s viewed through the lens of the customer. For example:

- Want to be more profitable? Investigate why customers are returning products and where changes could be made to improve the product quality or shipping process.

- Need to boost your sustainability credentials? Listen to what really matters to the customer and make changes where you won’t be accused of simply greenwashing.

- Increase brand loyalty? No problem, walk the customer journeys yourself to identify broken, or cumbersome processes, and improve them through brilliant basics.

It’s a good idea to maintain a list of CX improvements, identify your top 10 priorities, and assign an executive owner to each.

Do you see the whole picture?

It’s not enough to simply hold someone to account for collating the data, because this is unlikely to reveal the full picture. While we may run metrics in parallel, often, it’s not until we analyse data sets together that we understand why the business is experiencing growing pains and identify the volatile touchpoints. For example:

- Your customer service team may hit its SLA to contact customers within 2-hours. But if the support team doesn’t follow up, you’ve got an unhappy customer.

- You might see a rise in the return of winter jumpers because customers aren’t happy with their cashmere bobbling. But this is perfectly natural and should be highlighted at the point of purchase.

- Perhaps you’ve done your job perfectly, but your outsourced logistics delays delivery and the first time you know customers aren’t happy is when you read it on Twitter.

Again, when you focus on how to overcome a specific problem that directly links to your corporate strategy, you need to consider everything to understand the bigger picture. These insights then directly feed into the sales projections so the Board can understand exactly how each metric impacts the organisation’s ability to reach its targets. With greater visibility, the business is afforded the time it needs to take action to make appropriate changes that keep the strategy on track – rather than hit the end of the quarter and wonder why you missed the target again.

Want to know more about how S&S can help you and your organisation?

- Sign up for our fortnightly newsletter The Pulse with cutting edge business insights from our experts.

- If you’re a senior leader or change agent, join one of our change communities to network and share with like-minded individuals.

- If you have a problem that needs solving across business change, agility, leadership or transformation and you don’t want to go down the big, traditional consulting route-